A big change has happened that will shake-up the outdoor cooking landscape. It was announced that Weber and Blackstone are combining into one company.

The deal is expected to close in early 2025, subject to regulatory clearance and traditional diligence items. Once the deal is closed, the combined company will still keep their Palatine, Illinois location, where Weber is headquartered, and Logan, Utah, where Blackstone is headquartered.

We are thrilled to join with Weber and bring together two outdoor cooking industry innovators to create immense value for our customers and team members alike. With our complementary portfolios and similar cultures, I could not have imagined a better partner for Blackstone than Weber. We look forward to delivering an enhanced lineup of high-quality products to those with a passion for outdoor cooking, both here in the U.S. and internationally.

Roger Dahle, CEO of Blackstone

Strategic Value

Weber is a 70-year old brand that’s rich in tradition of gas and charcoal grills. Blackstone on the other hand created the griddle category a little over 15 years ago and rocketed through effective marketing across multiple platforms.

Their differences are why there’s likely quite a bit of strategic value to unlock with the combined company. Weber has recently expanded into griddles, but is nowhere near the market dominating force that Blackstone is.

With an estimated market share of over 80% in griddles, Blackstone has been looking to expand into other categories. They released pizza ovens, upscale griddles, and outdoor kitchen equipment.

We share Blackstone’s customer-centric emphasis and deep commitment to continuous innovation, and we believe that combining will allow both brands to better serve existing and new customers with the best-in-class outdoor cooking products they seek. Roger Dahle and his team have built a dynamic brand in outdoor griddles that has demonstrated both impressive growth and enduring appeal. We are excited by the enhanced opportunities this combination will create for our customers.

Alan Matula, CEO of Weber

It’s much faster, and often cheaper, to buy a brand in a new category than create one. This merger gives each company coverage in new areas that they were working on building.

Supply Chain Benefits

An area that Blackstone will see a great benefit with Weber is through their brand and supply chain. In 2021, North American sales at Blackstone accounted for more than 99% of total revenue.

Weber is a much more global brand. For the last quarter they reported in December 2022, about 59% of their revenue came from the Americas. They have as many as 22 global distribution facilities to serve 78 countries. That’s presents a big opportunity for international distribution of Blackstone’s products.

On the supply side, there’s also opportunity for Blackstone. We’ll get into ownership later, but Blackstone’s majority owner is also their primary manufacturer, Xiamen Cowell, which is based in Xiamen, China.

It’s been a key partnership for Blackstone to scale their business as well as they have. It also could be limiting though if their manufacturing has to be done at the facilities in China. That’s especially true if tariffs are imposed on China, as has been speculated.

Weber has a more diversified supply chain with three manufacturing facilities in Illinois with core competencies in metal fabrication, welding, deep drawn stamping and porcelain-enameled coatings. They also have relationships with 15 grill manufacturers in China and Taiwan to diversify their supply base.

We don’t know if this philosophy has remained through the grill slowdown, but in 2020, they also implemented a “Make Where We Sell” philosophy. That led them to build a manufacturing facility in Poland to support their EMEA business.

Scale

No financial numbers related to the companies or the transaction were released. We do have bits and pieces of historical information to approximate the combined size though.

Back in February, Blackstone noted that they had $650 million in annual sales. When Weber was going through the process of becoming a private company, their internal forecast put them at an expected 2023 revenue of $1.45 billion. That puts the combined company at about $2.1 billion in annual revenue.

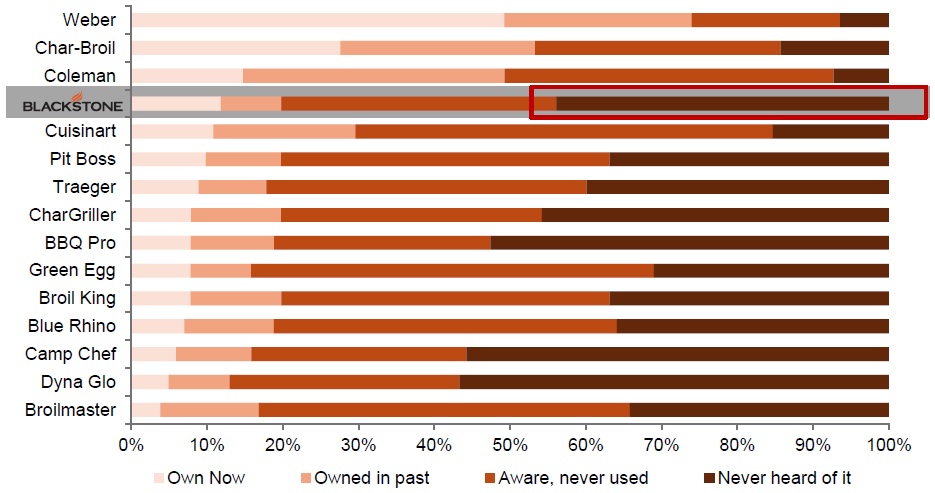

The combined company will also have considerable market share. Below is a graph that Blackstone provided during their IPO process.

This chart has moved around since it was presented, but Blackstone was estimated to have the fourth largest ownership. Adding that to Weber’s puts the combined entity at with ownership well above 60%.

New CEO

Beyond the news of the combined company, there was also big news about who is going to lead it. Despite Weber being the much larger company and brand, Roger Dahle, the founder of Blackstone, will be the new CEO.

He’ll take over for Alan Matula, the current Weber CEO, who will retire. Alan began as CEO in 2022 to help stabilize the brand once the grill market was tanking.

Roger Dahle will also have a considerable equity stake in the combined entity. Weber is currently privately held, after a brief stint being publicly traded.

It will be exciting to see what Roger can do at the helm of the combined company. He’s a true entrepreneur that pushes innovation. Those qualities, with Weber’s capabilities, should be a recipe for really great outdoor cooking products.

Industry Consolidation

Both in the good times and the bad over the past few years, there’s been considerable industry consolidation. Beyond this major news, other consolidation that’s taken place recently is Charbroil’s parent company, W.C. Bradley’s acquisition of Dansons (Pit Boss, Louisiana Grills).

Camp Chef is on track to sell through their parent company in January 2025. Innovative grill company HALO sold their business earlier this year.

During the boom times, we saw Middleby buy Char-Griller, Kamado Joe, and Masterbuilt. Pellet grill company, Grilla Grills, sold to American Outdoor Brands.

That’s just a sampling of the activity on manufacturer side. The retail side has also seen consolidation.